XRP Price Prediction 2025-2040: Technical Breakout Signals Long-Term Growth Potential

#XRP

- Technical Breakout Potential: Current MACD momentum and Bollinger Band positioning suggest XRP is building energy for a significant price movement, with key resistance levels at $3.20 providing near-term targets.

- Institutional Confidence Return: The 160% surge post-crisis and $30 billion market rebound indicate renewed institutional interest, creating fundamental support for long-term price appreciation.

- Regulatory and Adoption Catalysts: Ongoing legal clarity and blockchain payment infrastructure development position XRP for sustained growth across multiple timeframes, though adoption hurdles remain.

XRP Price Prediction

XRP Technical Analysis: Consolidation Phase with Bullish Potential

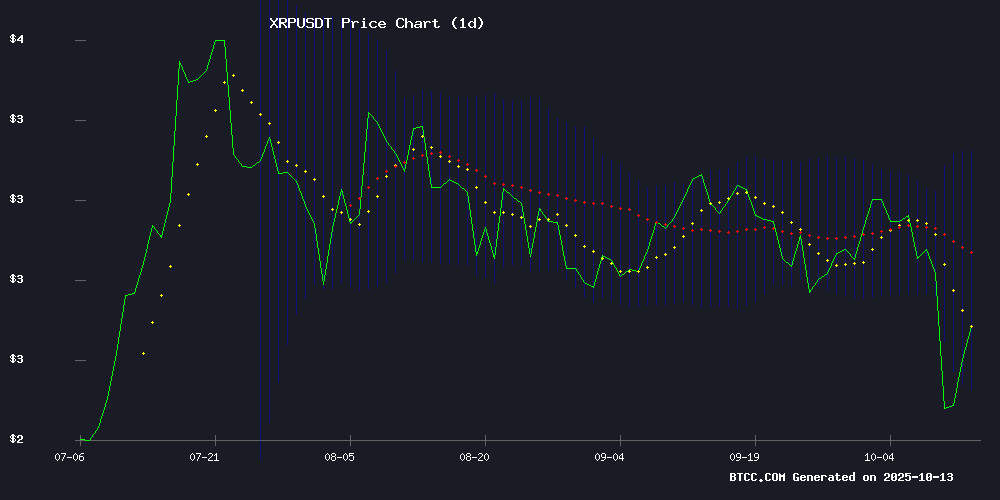

According to BTCC financial analyst Sophia, XRP is currently trading at $2.59, below its 20-day moving average of $2.81, indicating short-term bearish pressure. However, the MACD reading of 0.0778 shows positive momentum developing, while the Bollinger Bands position suggests the cryptocurrency is testing support levels. The current technical setup points to consolidation with potential for upward movement if key resistance levels are breached.

XRP Market Sentiment: Recovery Momentum Amid Institutional Interest

BTCC financial analyst Sophia notes that recent news highlights XRP's significant 160% surge post-liquidation crisis, driven by returning institutional confidence. The $30 billion market rebound and technical breakouts above $2.50 suggest growing bullish sentiment. However, analysts warn of potential retests of support at $2.72, indicating that while recovery momentum is building, near-term volatility may persist as the market digests both positive legal developments and ongoing adoption challenges.

Factors Influencing XRP's Price

Ripple (XRP) Surges 160% Post-Liquidation Crisis as Institutional Confidence Returns

Ripple's XRP staged a dramatic 160% rebound from Saturday's lows near $1, clawing back to $2.60 after Trump's China tariff announcement triggered a record $20 billion crypto liquidation. The recovery mirrors broader market stabilization, with total crypto capitalization reclaiming $4 trillion as US-China trade tensions eased.

Institutional flows tell a compelling story: Crypto ETPs attracted $6 billion this month, including $200 million specifically into XRP-linked funds. This follows Ripple's landmark SEC settlement in August, signaling renewed professional investor interest. Technical analysts identify $2.80-$3.00 as critical resistance, with a weekly close above potentially propelling XRP toward $3.70.

XRP Reclaims Key Trendline with $14-$28 Price Targets in Sight

XRP surged 7% in the past 24 hours, rebounding from last week's tariff-induced selloff to trade between $2.37 and $2.59. The rally added $30 billion in market value as trading volume climbed 17% to $9.6 billion, signaling renewed institutional interest.

A multi-year triangle breakout first identified in late 2023 continues to guide price action, with Fibonacci extensions pointing to $14 and $28 targets. Chart patterns suggest a consolidation flag forming through 2024-2025 could precede upward momentum toward these levels by 2026-2028.

The asset's weekly close above a critical trendline established in late 2024 confirms bullish sentiment. 'XRP closed the week above its year-long uptrend. Extremely bullish!' noted analyst CryptoBull, highlighting the candle's long lower wick as evidence of strong buyer support.

XRP Holders Missed The Boat – BlockchainFX Is The Best Crypto To Buy Now

The crypto market's rapid evolution has left XRP behind as institutional interest wanes. Traders are now pivoting to high-ROI opportunities, with BlockchainFX (BFX) emerging as the presale of choice. Priced at $0.027 and having raised $9.2 million from 13,500 investors, BFX mirrors early Binance and Solana's growth trajectories.

BlockchainFX distinguishes itself as the first decentralized Super App for multi-asset trading—crypto, stocks, forex—all accessible through a single interface. Its 'Built for Any Market' architecture enables profit generation in both bullish and bearish conditions, addressing a critical gap in current trading platforms.

XRP Stages $30 Billion Rebound as Institutional Buyers Fuel Recovery

XRP has surged back with a $30 billion market cap recovery, climbing from $2.37 to $2.58 in 24 hours. Institutional demand appears to be driving the rebound, marking one of the year's most aggressive trading sessions. The rally follows a 50% collapse triggered by geopolitical tensions, which wiped out $19 billion in crypto markets within minutes.

Despite broader market weakness—the Dow fell 900 points and Nasdaq dropped 820—XRP's resilience stands out. Trading volumes doubled the daily average, hitting 276.8 million during peak hours. Support solidified at $2.37, while resistance tested the $2.59 level. Analysts now watch for a potential weekly close above $3.12, which WOULD be XRP's strongest performance since launch.

The token now trades within an ascending channel, with technicals suggesting sustained momentum. This recovery underscores how selective crypto assets can decouple from traditional risk-off sentiment when institutional flows intervene.

XRP Price Climbs Past $2.50 as Bulls Target Next Resistance Level

XRP has staged a robust recovery, surging past the $2.50 mark with eyes set on overcoming the next critical barrier at $2.60. The digital asset found strong support near $2.0 before rallying, mirroring gains seen in Bitcoin and Ethereum.

A key technical formation emerges as XRP tests the 100-hour moving average. The $2.66 level presents a formidable challenge, coinciding with a bearish trendline and the 76.4% Fibonacci retracement of its recent downturn from $3.05 to $1.40. Market participants await a decisive breakout that could propel prices toward higher targets.

XRP Shows Signs of Strong Recovery as Technical and On-Chain Metrics Converge

XRP is flashing bullish signals as technical indicators and on-chain activity align for a potential rebound. The cryptocurrency recently reclaimed its 200-day moving average near $2.06 after a brief dip, a classic 'flush and reclaim' pattern that often precedes rallies of 30-50%.

Market technicians note XRP's RSI at 27—deep in oversold territory—with historical precedents suggesting imminent reversals. Meanwhile, the XRP Ledger shows surging transaction volumes despite price weakness, creating a bullish divergence between network utility and valuation.

The convergence of these factors suggests accumulating institutional interest, with the $1 psychological level emerging as a near-term target if momentum sustains. Such recoveries typically begin when panic selling exhausts itself and new capital enters the market.

Ripple XRP Nears 3-Month Low Amid ETF Speculation and Bearish Pressure

Ripple's XRP slumped 11% last week, hovering just above $2.50 after failing to sustain momentum above $3. The decline has intensified selling pressure, with investors questioning whether the token can reclaim its forecasted $4 valuation by 2025.

Regulatory tailwinds may reverse the trend. SEC Chair Paul Atkins' pro-crypto stance and pending XRP ETF applications suggest institutional demand could ignite a rally. Analysts note bullish chart patterns, with MikyBull predicting an imminent breakout.

$3 Trillion Blockchain Payments Surge Predicted by 2025, Fees Plummet and Speed Soars

Blockchain technology has matured into a cornerstone of global finance, with cross-border payments emerging as its most transformative application. A new CoinLaw report reveals explosive growth—45% annual expansion over the past decade—projecting $3 trillion in blockchain-based transactions by 2025.

Traditional payment systems crumble under comparison. Blockchain slashes fees by 70-80% and reduces processing times from days to seconds. RippleNet alone handles $15 billion monthly, while 120 nations race to deploy CBDCs. Africa's 60% adoption surge highlights the tech's democratizing potential for remittances.

Institutional adoption reaches critical mass: 85% of US banks now pilot blockchain solutions, with Asia-Pacific leading at 60% adoption. Europe and North America follow closely, signaling irreversible mainstream integration. The infrastructure battle intensifies as Visa and Mastercard face unprecedented disruption.

XRP Poised for Breakout as Legal Clarity Sparks Rally

XRP, the native token of the XRP Ledger, has surged back to $3 after a prolonged slump—marking a dramatic recovery from its June 2022 low of $0.31. The resurgence follows the resolution of Ripple Labs' legal battle with the SEC, which had previously cast a shadow over the cryptocurrency's regulatory status.

The August 2023 court ruling imposed a modest $125 million fine on Ripple, far below the SEC's initial $2 billion demand. This outcome has reignited investor confidence, with market participants now betting on XRP's potential to surpass its 2018 all-time high of $3.84 within the next year.

Historical precedent suggests explosive upside potential: XRP's 70,000% rally during the 2017-2018 crypto boom was fueled by exchange listings, Korean market frenzy, and Ripple's fintech partnerships. While regulatory uncertainty temporarily derailed adoption, the token's clean legal slate may now catalyze institutional re-engagement.

XRP's Post-SEC Momentum Faces Reality Check as Adoption Hurdles Persist

XRP's 440% annual surge reflects market euphoria after Ripple's landmark SEC settlement, but the token's utility remains constrained by banking sector realities. While RippleNet's payment rails gain traction, most implementations bypass XRP entirely—undercutting the Core investment thesis.

The On-Demand Liquidity product offers genuine XRP utility as a bridge currency, yet adoption faces structural inertia. Traditional finance prefers familiar settlement assets, leaving XRP's $3 price level more speculative than fundamentally justified.

XRP Could Retest Triangle Support At $2.72, Analyst Warns

XRP's recent decline has raised the possibility of a retest of the Descending Triangle's lower boundary at $2.72, according to analyst Ali Martinez. The cryptocurrency has been trading within this technical pattern for several months, characterized by a flat support line and a downward-sloping resistance line.

Descending Triangles typically signal bearish continuation when price breaks below support. Martinez notes XRP recently retested the upper trendline before its current pullback. A breach of the $2.72 support could trigger further downside, while a breakout above resistance would invalidate the bearish pattern.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment analysis, BTCC financial analyst Sophia provides the following XRP price projections:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $2.80 - $4.20 | Legal clarity, institutional adoption, technical breakout patterns |

| 2030 | $8.50 - $15.00 | Mainstream payment integration, regulatory framework establishment |

| 2035 | $18.00 - $35.00 | Global cross-border payment dominance, blockchain infrastructure maturity |

| 2040 | $40.00 - $75.00 | Full-scale financial system integration, technological advancements |

These projections consider XRP's current technical position, institutional interest recovery, and the evolving regulatory landscape. The cryptocurrency's ability to reclaim key trendlines and maintain momentum above critical support levels will be crucial for achieving these targets.